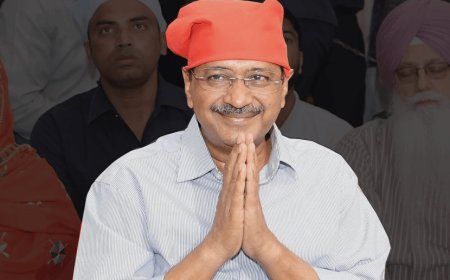

Gautam Adani is debtor of more than Rs 2 lakh 41 thousand crores!

Bank of Baroda was Rs 5380 crore and IndusInd Bank was Rs 4150 crore. There is a possibility of change in these figures since then. Along with Indian banks, Adani Group has taken loans from global banks. By the end of March 2024, foreign banks had given ₹ 63,296 crore as loan to Adani Group. A year ago i.e. in March 2023, this debt was ₹ 63,781 crore. As of March 2024, the group had taken a loan of ₹72,794 crore from Global Capital Markets.

US federal prosecutors have accused Gautam Adani and seven other people associated with the Adani Group of being involved in a Rs 2,100 crore ($250 million) bribery scam. The United States Attorney's Office alleges that bribes were paid to Indian officials to obtain contracts related to solar energy in India. After this news came from America, all the stocks of Adani Group fell badly today. The market value of shares of Adani Group companies declined by about $ 22 billion in early trading on Thursday. After Gautam Adani's name appearing in the bribery scandal in America, there is a danger of adverse impact on the business of Adani Group. If this happens then it will affect many Indian banks also. This is because many banks including State Bank of India have given huge loans to Adani Group companies. As of March 31, 2024, Adani Group had a total loan of Rs 2,41,394 crore, out of which it has given Rs 88,100 crore to Indian banks and Were taken from Non Banking Finance Companies (NBFCs). As of March 31, 2023, the total debt on the group was Rs 2,27,248 crore and the share of Indian banks in it was Rs 70,213 crore. Banks like State Bank, Bank of Baroda, Union Bank of India, HDFC Bank, Axis Bank etc. have given loans to Adani Group. The information about how much loan has been given to Adani Group by which bank is not yet known. But, after the Hindenburg report in January 2023, many domestic banks and financial institutions had informed about their exposure in Adani Group. At that time LIC had admitted to exposure of Rs 35920 crore in the group, of which Rs 30,130 crore was in equity and Rs 5790 crore. Was in debt worth crores of rupees. The total exposure of SBI was Rs 27 thousand crores. Whereas the exposure of Axis Bank was Rs 9220 crore, Punjab National Bank was Rs 7 thousand crore, Bank of Baroda was Rs 5380 crore and IndusInd Bank was Rs 4150 crore. There is a possibility of change in these figures since then. Along with Indian banks, Adani Group has taken loans from global banks. By the end of March 2024, foreign banks had given ₹ 63,296 crore as loan to Adani Group. A year ago i.e. in March 2023, this debt was ₹ 63,781 crore. As of March 2024, the group had taken a loan of ₹72,794 crore from Global Capital Markets.

What's Your Reaction?