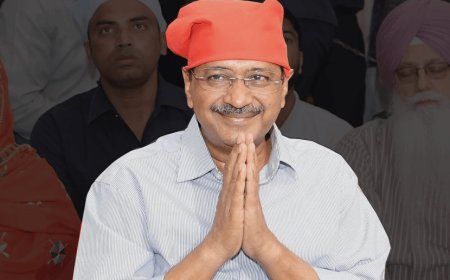

ITR filers increased by 132% in 10 years! Direct tax collection increased by 182%

when Modi government came to power in the financial year 2014-15, the direct tax collection was Rs 6,95,792 crore (about Rs 6.96 lakh crore), which will increase in the financial year 2023-24. It has increased to Rs 19,60,166 crore (Rs 19.60 lakh crore). That is, during the 10 years of Modi government's tenure, the direct tax collection which includes Income Tax, Corporate Tax and Securities Transaction Tax (STT) is Rs 12,64,374 crore (about Rs 12.64 lakh crore) i.e. 182 percent. There has been a surge. financial year

The number of people filing Income Tax Returns has seen a doubling in the last 10 years. A total of 3,79,74,966 income tax returns were filed for the financial year 2013-14, the number of which has increased to 8,61,32,779 in 2023-24. That means, during the last 10 years of Modi government's tenure, the number of people filing income tax returns has increased by 4,81,57,813. That means the number of people filing IT returns has increased by 127 percent in 10 years. The Central Board of Direct Taxes (CBDT) has released time-series data for the financial year 2023-24. According to this data, 3,50,43,126 individual taxpayers had filed income tax returns in the financial year 2013-14, whose number has increased to 8,13,90,736 in 2023-24. The number of taxpayers belonging to the Individuals category who have filed IT returns has increased by 4,63,47,610 in the last 10 years. That means the number of people who have filed income tax returns has increased by 132 percent in the last 10 years. According to the Income Tax Department, the number of all taxpayers holding PAN Card in the assessment year 2013-14 was 5,26,44,496, which has increased to 10,41,13,847 in the assessment year 2023-24. . In this, the total number of individual taxpayers was 4,95,76,555 in assessment year 2013-14, which has increased to 9,91,75,656 in assessment year 2023-24. That means, during 10 assessment years, the number of individual taxpayers has increased by 100 percent i.e. double. According to the data of CBDT (Central Board of Direct Taxes), when Modi government came to power in the financial year 2014-15, the direct tax collection was Rs 6,95,792 crore (about Rs 6.96 lakh crore), which will increase in the financial year 2023-24. It has increased to Rs 19,60,166 crore (Rs 19.60 lakh crore). That is, during the 10 years of Modi government's tenure, the direct tax collection which includes Income Tax, Corporate Tax and Securities Transaction Tax (STT) is Rs 12,64,374 crore (about Rs 12.64 lakh crore) i.e. 182 percent. There has been a surge. financial year

What's Your Reaction?